Google for Startups Black Founders Fund Invests in A.M. Money

Today, we are ecstatic to announce that we can include Google for Startups as one of those supporters as we are one of the recipients of funding from their new Black Founders Fund.

We started A.M. Money four years ago because of the challenges I had paying for college after leaving the military. As the story goes I had to beg my grandmother to co-sign on a high-interest rate student loan so I could make it through.

It was a deeply frustrating experience, as I had seemingly done everything I was supposed to do and it meant little to the existing system. At the same time, I was grateful for my grandmother, and several other individuals and organizations who stepped up to help me get through college and to the places I was eventually able to go.

Our Organization is dedicated to ensuring that financing is not the same constraint as it was for me, and to make that pathway just a little bit easier for the people walking a comparable road to me.

I’ve found it deeply ironic that my experience building, and helping grow this organization has had its own comparable journey. I never expected this journey to be easy, but it's certainly been more challenging than I would probably have expected.

Nevertheless, we have now, just as I did before, persisted. It’s been our honor to pick up a number of supporters and investors dedicated to building a business that makes sure stories like mine are a thing of the past.

Today, we are ecstatic to announce that we can include Google for Startups as one of those supporters as we are one of the recipients of funding from their new Black Founders Fund.

This is the cherry on top of what has been a monumental quarter for the organization. We closed our 3.5m Seed round with Lightbank with participation from existing and new investors including: Octava Impact, Don and Elizabeth Thompson, Michael Alter, Shayne Evans, and Tim Knowles along with others within the Chicago Ecosystem.

This new funding corresponds with a 33x year over year increase in loan requests for the fall quarter. Now, more than ever, the need for what we are doing is clear. As such, we continue to fight to give low-income students across the city, state, and country every opportunity to graduate from college, find quality employment, and build wealth.

We urge you to join us in this work.

Check out the link below for more information on how you can support A.M. Money and our mission, and of course feel free to reach out to Daniel or our team at any time.

PRESS RELEASE | Another Support for A.M. Money Students

A.M. Money, Neighborhood Trust Launch Pilot to Set Recent College Grads on Path to Financial Security

Pilot program to enable college grads to receive TrustPlus financial coaching, build foundation for financial health as they enter a challenging job market

TrustPlus is the first in a suite of tools and products that A.M. Money will offer over the next year

CHICAGO, IL -- July 8, 2020 -- A.M. Money, a Chicago-based student loan company that provides low-interest, no-cosigner loans to low- and middle-income college students, is partnering with the nonprofit Neighborhood Trust Financial Partners, a national leader in the field of worker financial health, to provide TrustPlus, a financial coaching benefit delivered via employers and fintechs, to recent college graduates.

College graduates who have a student loan from A.M. Money will have access to the financial coaching app as part of A.M. Money’s job onboarding package. TrustPlus is the first of a suite of tools and products A.M. Money will begin to roll out over the next year to help its student loan borrowers successfully navigate the post-college effort to secure employment and start a career.

“We know this is a very important and complex financial moment, and we’ve learned that for many of our students, they are more or less thrown out into the working world with no support whatsoever,” said Daniel Rogers, Founder and CEO of A.M. Money. “For years we’ve been spending hours to informally counsel our students through this moment. The ability to partner with a best-in-class service like TrustPlus will provide a great opportunity for us to formalize and scale up this support for all of our graduates.”

“We’ve seen time and again how student loan debt can impact not only how workers manage their hard-earned money, but also what jobs to take and when or whether to buy a home or start a family,” said Justine Zinkin, CEO, Neighborhood Trust. “We built TrustPlus to be the human coaching feature of industry leading fintechs that solve for workers’ financial precarity. TrustPlus Financial Coaches will serve as an important feature of the A.M. Money experience, easing the burden of student loan debt and other financial challenges for new grads and helping them create financial security as they launch their careers.”

In the wake of the coronavirus pandemic, college students graduating this year are entering one of the toughest job markets since the Great Depression; more than 45 million people have applied for unemployment insurance since March and the number of entry-level job postings (typically filled by recent college graduates) has fallen 73 percent over the past three months. Additionally they join the nearly 45 million people holding $1.6 trillion in student loan debt in the U.S. With research showing that the economic effects from entering a job market during a recession can last 10 to 15 years, new grads will likely be making tough decisions that will have a reverberating effect on their financial health now and in the years to come. A.M. Money seeks to provide their student loan borrowers with support and resources like TrustPlus financial coaching to help them navigate the economic environment and create financial stability.

About Neighborhood Trust Financial Partners

Neighborhood Trust is a nonprofit social enterprise empowering workers to take control of their finances and achieve financial health. With nearly 25 years of financial coaching experience, we blend our trusted financial guidance with innovative technology solutions and actionable financial products to help workers make their paychecks go further. Neighborhood Trust embeds our services where workers get paid, access financial services and make financial decisions. Annually we reach nearly 10,000 low- and moderate-income workers across the country. For more information, visit www.neighborhoodtrust.org.

About TrustPlus

TrustPlus is a financial wellness benefit that helps workers make the most of every hard-earned paycheck. A service of Neighborhood Trust, our coaches demystify personal finance with empathy, providing on-demand, one-on-one support and expert guidance. Our unique approach blends human connection with action-oriented tools and workplace products to ease the burden of workers’ everyday money worries. In addition to serving as an employee benefit, we also are offered as the human coaching feature of worker-focused fintechs. Learn more at www.mytrustplus.org.

Partnership Shoutout - After School Matters

PARTNER SHOUTOUT: ASM! This year alone, we have had the honor of co-hosting multiple sessions: affordability workshops, Q&A sessions, and FinAid presentations. We even hosted two of their high school students this year as our social media interns! Our conversations have led to the creation of our Covid-19 Student Guide, our first Webinar on Financial Aid Appeals, and our routine check-ins and support of our student borrowers. As a whole, the ASM staff, instructors, and students have provided INVALUABLE insight into how we can help students get across the finish line. Can’t wait to continue working with this incredible organization! - Amanda, Director of Ops

The organizations we have partnered with over the last year have given us opportunities to connect to our roots: students. After School Matters is no exception! ASM is a well known opportunity for Chicago students: connecting students to internships, apprenticeships, and assistantships to jump start their careers. And the students get PAID!! Now that’s what I’m talking about.

ASM is pervasive around the city of Chicago - many of my own friends are ASM alumni - and to have them as a partner is a badge of honor that we wear with pride. This year alone, we have had the honor of connecting to the many groups that they serve, from their high school freshmen during their ASM-University week, to their high school seniors at their send-off-to-college event, and to their incredible instructors. These sessions have been framed as workshops on how to afford college, Q&A sessions on what we wish we had known when we were trying to pay for college, and presentations on what students deal with during their financial aid process. We even hosted two of their high school students this year as our social media interns!

Our Strategic Partnerships Lead, Mike, and I at the 2020 ASM Instructor Forum

More broadly, partnerships like the one we have with ASM are critical to better understanding and effectively supporting students.

While we have provided critical financing to 50+ students this year, through our work with ASM, we have been able to learn from thousands more. As we’ve worked along with ASM’s program leaders, we have come to better understand how we can provide support above and beyond our financing for these students. Our conversations have led to the creation of our Covid-19 Student Guide, our first Webinar on Financial Aid Appeals, and our routine check-ins and support of our student borrowers.

As a whole, the ASM staff, instructors, and students have provided INVALUABLE insight into how we can help students get across the finish line. Can’t wait to continue working with this incredible organization!

-Amanda, AM Money Director of Ops

All About Financial Aid Appeals

As schools wrap-up their spring semesters and students turn their sights to the fall, it’s become apparent that the financial implications of Coronavirus are going to hit hard. Students who have never qualified for financial aid may now qualify for thousands, and students who were barely making tuition payments with their current aid status may now need to consider alternative financing or suspending their enrollment. That said, there is one option that shouldn’t be overlooked as a method to increase your aid and potentially save yourself a few thousand dollars on your tuition bill this year.

As schools wrap-up their spring semesters and students turn their sights to the fall, it’s become apparent that the financial implications of Coronavirus are going to hit hard. Students who have never qualified for financial aid may now qualify for thousands, and students who were barely making tuition payments with their current aid status may now need to consider alternative financing or suspending their enrollment. That said, there is one option that shouldn’t be overlooked as a method to increase your aid and potentially save yourself a few thousand dollars on your tuition bill this year.

What is a Financial Aid Appeal?

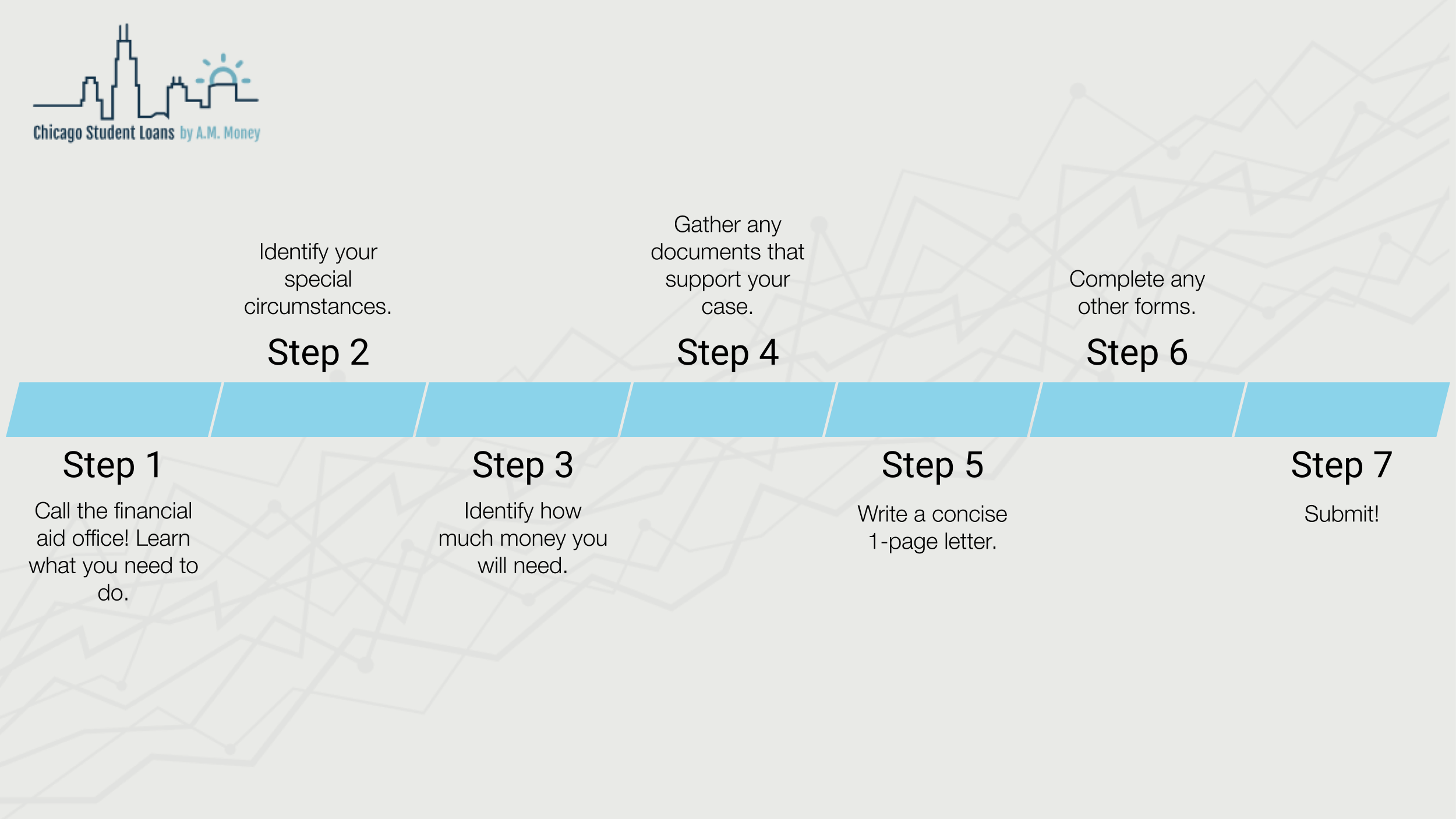

The Financial Aid Appeal process exists to help students make their case as to why they deserve more financial aid. If you get a financial aid award that’s less than you hoped — or if your financial circumstances have changed since you completed the FAFSA, which in this time period...pretty much applies to everyone — AND you need less than $7,500, your first action should be to appeal your financial aid.

The Appeal itself is an explanation, usually written to the financial aid office, as to why you will need more financial support to attend a semester/year of school. Your financial aid office will likely have its own process, so you’ll need to call them to find out more about what the steps are.

What Could Constitute an Appeal?

At this point, your best bet is to appeal for as many of the following situations as are applicable:

Job loss or decrease in income

Divorce or separation of a dependent student’s parents

Death of a dependent student’s parent

Special needs or disabled children

Unreimbursed medical and dental expenses

Catastrophic loss, such as damage or loss from a natural disaster

Textbook costs beyond the standard allowance in the cost of attendance

Change in the student’s marital status

Dependency override

End of child support, Social Security benefits for a child or alimony payments

Pretty much anything related to the Coronavirus

Common appeals at this point will likely center around students or family members losing their job and thus having less money to contribute towards school.

When Should I Appeal?

IMMEDIATELY! Call your Financial Aid office to learn more about the process.

What Does the Appeal Process Look Like?

Below is a brief overview of what the process is going to look like for most students:

Templates

Looking for some examples of what you can use when writing up your aid letter? Look no further! Check the below templates and use what works for you:

I Have More Questions

We’ll be reviewing the entire Appeals Process and providing tips and tricks on Friday, May 22 at 12pm CT and we’d love to see you there! For more information and to register, please check out the link below:

Additionally, you can contact us at anytime by reaching out to Mike Jank at mike@a-m.money